|

|

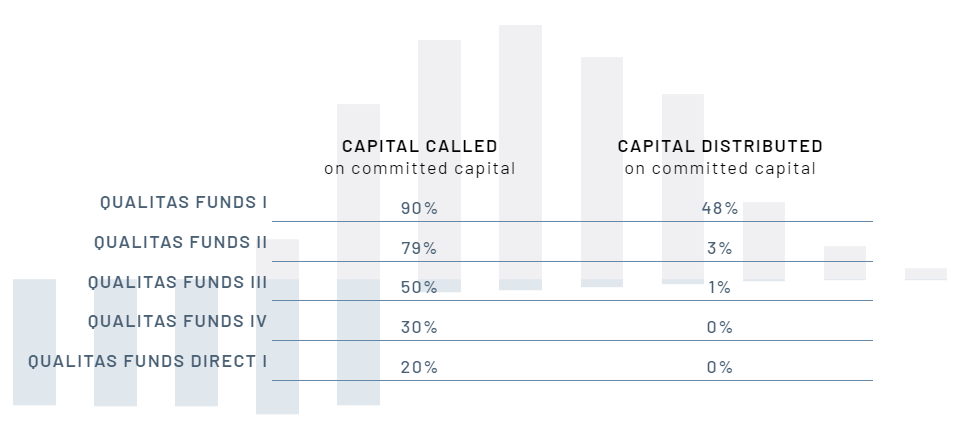

Current state

|

|

|

|

Cashflows estimation for Qualitas Funds' investors

|

|

- Qualitas Funds I: We anticipate the last capital call in May of the

remaining 10% of commitments, taking the fund to 100% capital called. We expect

strong distributions in 2022. The forecast is to end the year having distributed

more than 100% of the fund.

- Qualitas Funds II: No further capital calls are expected until the

second half of the year. Additional distributions are expected in the short term (c.

3% of commitments).

- Qualitas Funds III: The next capital call will likely take place at

the end of Q2 or the beginning of Q3.

- Qualitas Funds IV: Thanks to the extraordinary performance of our

GPs, the first distribution of 3-5% of investor commitments is anticipated in Q2

2022. A 10% capital call is expected toward the second half of 2022.

- Qualitas Funds Direct I: The next capital call is anticipated in Q2

2022 of 10% of total commitments. We expect to be at 40-50% capital called at year

end.

*These figures may not be accurate for SCR vehicles.

|

|

|